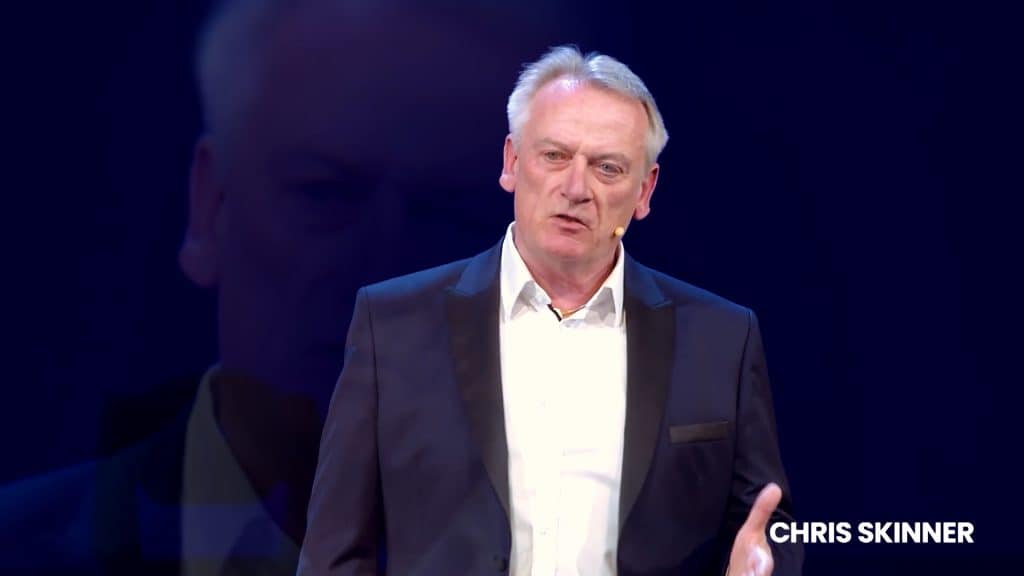

Chris Skinner

[favorite_button post_id=""]

Chris Skinner

Chris Skinner is an award-winning speaker and one of the most influential people in technology, as well as a best-selling author. He is an independent commentator on the financial markets and fintech through his blog, the Finanser.com, which is updated daily.

He helped to found one of the first mobile banks in the world and has advised CEOs and leaders from every continent of the world including the United Nations, the White House, the World Bank and the World Economic Forum.

Contact Great British Speakers today to book tech, finance, business, fintech keynote speaker, Chris Skinner for your next event.

Type Of Talent

More About Chris Skinner

His latest book (seventeenth!) is Digital for Good, focusing upon how technology and finance can work together to address the environmental and social issues we face today and make a better world. His previous books include Doing Digital, which shared the lessons of how to do digital transformation through interviews with leading global banks such as BBVA, China Merchants Bank, DBS, ING and JPMorgan Chase; Digital Human, which showed how digitalisation is a revolution that allows everyone from the plains of Africa to the mountains of Tibet to be included and served by the network; and Digital Bank that provides a comprehensive review and analysis of the battle for digital banking and strategies for companies to compete. Chris has recently been added to The Mad 33 List for Inspirational change and transformation leaders – making a difference – making the future a reality.

Chris Skinner | Awards and Accolades

He is a non-executive director of 11:FS and on the advisory boards of many FinTech and financial firms including WebAccountPlus. Chris is a visiting lecturer with Cambridge University as well as a TEDx speaker. In recent years, he has been voted one of the UK’s foremost fintech observers by The Telegraph and one of the most influential people in financial technology by the Wall Street Journal’s Financial News and Thomson Reuters. Chris is also a successful children’s author with a series, focused upon Captain Cake and the Candy Crew, released in 2021 Captain Cake. He is also co-founder with renowned artist Basia Hamilton of The Portrait Foundation, Portrait Foundation, a non-profit platform to encourage children and the arts.

Chris Skinner Speaking topics:

Chris Skinner | The decentralised smart companies of the future

Everything is becoming smart and connected, from our homes to our cars to our clothes. How does this change business, how we think and how we pay? If everything has GPT in its name, does that mean we have far less people working? If everything is decentralised, who regulates the system? How can you be artificially intelligent if you have dumb data?

This presentation looks at the key technologies coming downstream from artificial intelligence to artificial super intelligence, from cloud computing to quantum computing and from cryptocurrencies to central bank digital currencies. The big question it tries to answer is the role of centralised institutions in a decentralised world.

Chris Skinner | The past, present and future of banking, finance and technology

Finance has changed massively in the past years thanks to the rise of cloud computing and the mobile network. For the traditional institutions, this means a radical overhaul of the analogue business model. For the new firms of fintech, it has offered a massive opportunity to digitalise the industry. How will this all turn out? What is the future? How should a traditional firm invest and prioritise to be digital? How should a start-up work out their way to success? This presentation takes you through all the nuances of the past, present and future of banking, finance and technology, and how to navigate a way to winning.

Chris Skinner | Doing Digital – Lessons from Leaders

There are a small group of banks who are transforming to be digital banks. As we all know, this is incredibly difficult for a long-established bank with thousands of people and millions of customers. What are they doing right? How are they doing it? Why do we think they are digital banks? Is there a way we could all follow their path? Chris Skinner has been travelling the world for years, talking to banks that are doing digital. He selected five to be case studies – JP Morgan Chase, ING, BBVA, DBS and China Merchants Bank. From those interviews and discussions, Chris has found many lessons from banks that are doing digital right, and will share these lessons with the audience.

Chris Skinner | How banking and fintech improves society and the planet

This presentation looks at everything from how banking plays a role in the climate emergency through to the FinTech world using technology to overcome issues of inequality and inclusion. The themes include questioning the purpose of banking, and whether it is socially useful; how purpose can impact a bank’s role in the climate emergency; the way in which we can use finance to do good for society and the planet; the latest developments in cryptocurrencies; and more.

After the 2008 financial crisis, banks were described as being socially useless by the UK regulator. How is this changing? Amazingly, through FinTech and digital services, it is changing dramatically. There are now many movements across the network to use financial transactions to be good for society and good for the planet. What’s happening and who is driving this change? What does it mean for banks and what happens when you say you are green when, in fact, you are not? This presentation explores all of these themes in depth and demonstrates that digital transformation and green finance are actually coming together hand-in-hand.

Why book Chris Skinner?

Chris Skinner is a world renowned, award-winning strategist who specialises in the future of business, technology and finance. Author of more than twenty best-selling titles from Digital Bank to Digital Human, he is famed for delivering powerful keynote speeches and moderating and chairing with lightning-rod insights. His experiences range from everything to do with banking, fintech, technology and the future, with a specific focus upon how cloud computing, mobile and networking, artificial intelligence and machine learning, central bank digital currencies and cryptocurrencies and related changes are shaping the future of our world.

Chris is not a showman. He’s a knowman. Steeped in the industries of business, technology and finance, he has the future of these industries in his DNA. Why? Well, years ago, someone told Chris to tell them something that they don’t know. This went to Chris’s heart as the only thing we don’t know is the future. Having said that, he’s not a futurist. He calls himself a commercial strategist and defines this as someone who looks to the future to see how to create a strategy for tomorrow to make more money.

But it’s not all about money. As a mature father, Chris also wants to create a secure future and one that is good for his kids. This is why his challenge to you today is: how can we use technology and finance to make money and make the world a better place? He claims to have the answers, which is why you need to choose him as your speaker.

Call +44 1753 439 289 or email Great British Speakers now to book technology, finance and fintech speaker Chris Skinner for your next live or virtual event. Contact us.

Get In Touch